The rebirth of the rebirth of distance

It’s been quite a while since the last big fuss about ‘peak oil’: hardly surprising, once oil fell from its pre-crash peak. A guy who made a lot of that fuss is back giving his post-crash perspective in a video. He believes the ‘local vs. global’ balance could be about to change

When social innovation is a matter of life and death

But does it scale? What if scalability, instead of being assessed in terms of ‘financial growth potential’, has to be measured in terms of ‘social impact’?

We’re universities and we’re being globalized

The developing world has an insatiable hunger for everything our best universities have to offer. Are those universities doing enough to address this?

Preventing socially unacceptable disruption: the impact of startups on local culture

We’re all being asked to consider environmental impact these days, but is ‘cultural impact’ also something that startups should be expected to care about?

Financiers pay the ultimate price in socially-funded horror

This impressive panel investigates radical funding ideas for new projects. Included is the possibility that it might be possible to dispense with ‘investors’ altogether, in some cases with amusingly ‘horrific’ alternatives

The startup incubator: economic policy panacea or money-pit

Does Y Combinator’s unquestionable success justify using ‘startup incubators’ as the basis for strategic innovation policy?

Why not pay the unemployed to create startups?

Or how you might create the really big society. Yes, it will probably create some serious chaos. But who said being disruptive should be tidy?

Would replacing some bankers with meteorologists have prevented the crisis?

It wasn’t greed after all. Neuroscience shows that experts make illogical decisions when confronted with unprecedented circumstances, because experience can force you to unconsciously override logic in favour of your established beliefs. Experts in entirely unrelated fields need to be brought in on crucial decisions

The restaurant at the beginning of the universe

Welcome to the birthplace of investment in the online world. It’s the relaxed watering hole where the big stuff happens in Silicon Valley. The regulars constitute a “who’s who” of movers and shakers behind what’s going on right now.

Who is Mr Prediction in Tech?

This year was expected to be so full of unprecedented upheavals that getting it right would be tougher than ever.

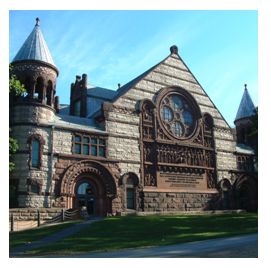

Turning university science breakthroughs into businesses

A superb panel video from Princeton covers just about everything: Angels, Venture Capital, Intellectual Property as well as the academic, engineering and technology licensing perspectives

Watch influencers offer predictions on major tech acquisitions

The second half of 2010 is looking better than last year, a surge is expected, heralding a very hectic end of year M&A traffic jam

The quango as heroic green knight?

Private equity hesitancy contrasted with prompt public funding of green innovation

The valley’s angel scene is going crazy

It’s unrecognisable from just a few years ago: lots more angels, much bigger sums, many more investments

Secretive leading biotech dealmakers caught talking unguardedly on video

MIT somehow managed to make this happen in New York recently (warning: contains disturbingly graphic images of a ‘banker guy’ talking candidly about pharma deals)

Haunted by the price of commercial success: using up the planet’s resources

Who you gonna call? These guys aren’t Ghostbusters, but they do believe they’ve discovered how to banish the spectre of industrial wastefulness

Fertiliser firm steps up into vertical farming

US fertilser firm Converted Organics has bought vertical farming specialist TerraSphere and entered the pharmaceuticals market

Round-up: big bucks for Sybase

SAP sees advantages of mobile access and new options in the world of social networking.

UK Innovation fund launches to help start-ups

The British government has begun the process of distributing £325 million to small and medium-sized businesses.

Businesslike approach puts UK start-ups ahead

The UK provides the best environment for innovation investment according to BASF Venture Capital investment manager Dr Oliver Guthmann.